Nationwide Auto Insurance Quotes Comparison takes center stage in the quest for the best coverage and rates. Get ready to dive into the world of insurance comparisons with a twist of interactive fun!

When it comes to finding the right auto insurance coverage, comparing quotes is key. It not only helps you save money but also ensures you get the best policy tailored to your needs.

Introduction to Nationwide Auto Insurance Quotes Comparison

When it comes to finding the best auto insurance coverage, comparing quotes is essential. Auto insurance quotes comparison involves evaluating different insurance options to determine the most suitable policy for your needs.

By comparing quotes from various insurance providers, you can identify the coverage options, premiums, deductibles, and discounts offered by each company. This allows you to make an informed decision based on your budget and coverage requirements.

Benefits of Utilizing Nationwide for Auto Insurance Quotes Comparison

- Wide Range of Coverage Options: Nationwide offers a variety of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. By comparing quotes from Nationwide, you can find the coverage that best suits your needs.

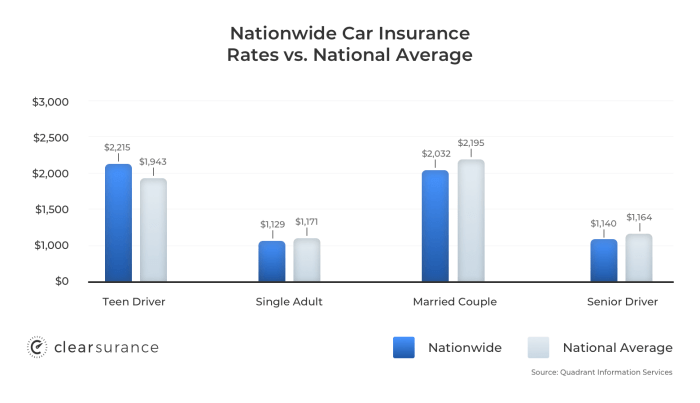

- Competitive Rates: Nationwide provides competitive rates for auto insurance policies. By obtaining quotes from Nationwide, you can compare their rates with other insurance companies to ensure you are getting the best value for your money.

- Customer Service Excellence: Nationwide is known for its excellent customer service. When comparing quotes from Nationwide, you can experience their superior customer support and assistance in choosing the right policy for you.

Factors to Consider When Comparing Nationwide Auto Insurance Quotes

When comparing Nationwide auto insurance quotes, there are several key factors to keep in mind to make an informed decision. Understanding how coverage options, deductibles, discounts, and customer reviews impact the quotes is essential for finding the most suitable policy for your needs.

Coverage Options

- Consider the type and extent of coverage offered by each policy, such as liability, collision, comprehensive, and personal injury protection.

- Ensure that the coverage options align with your specific needs and provide adequate protection in case of accidents or other unforeseen events.

- Compare the cost of adding additional coverage options to determine the overall value of each policy.

Deductibles

- Understand how deductibles work and how they affect your insurance premiums. A higher deductible typically results in lower premiums, but you will pay more out of pocket in the event of a claim.

- Evaluate your financial situation and risk tolerance to determine the most appropriate deductible amount for your circumstances.

- Compare deductible options across different policies to find the right balance between premium costs and out-of-pocket expenses.

Discounts

- Take advantage of any discounts offered by Nationwide or other insurance providers, such as multi-policy discounts, safe driver discounts, or discounts for anti-theft devices.

- Ask about eligibility requirements for each discount and calculate the potential savings to see how they impact the overall cost of the policy.

- Compare the total cost of each policy after applying discounts to determine the most cost-effective option.

Customer Reviews and Ratings

- Research customer reviews and ratings for Nationwide and other insurance companies to gauge their reputation for customer service, claims processing, and overall satisfaction.

- Consider feedback from current policyholders to understand their experiences with the company and how they rate the quality of service provided.

- Use customer reviews and ratings as a valuable resource when comparing Nationwide auto insurance quotes to ensure you choose a reliable and reputable insurer.

Using Nationwide’s Online Tools for Auto Insurance Quotes Comparison

When it comes to comparing auto insurance quotes, Nationwide offers a user-friendly online platform that makes the process easy and efficient. By utilizing their online tools, you can quickly obtain quotes and find the best coverage options for your needs.

Looking for the best deal on auto insurance? Get your Farmers Auto Insurance Quotes today! With Farmers, you can trust that you’re getting reliable coverage at a competitive price. Don’t wait, protect your car and your wallet now!

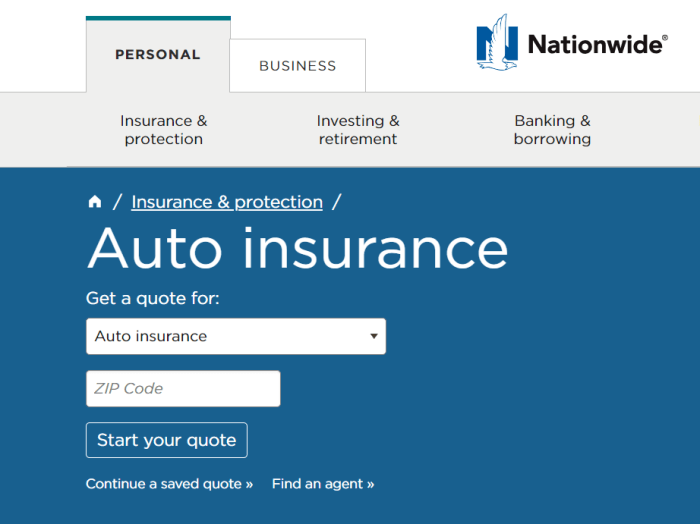

Accessing Nationwide’s Online Platform, Nationwide Auto Insurance Quotes Comparison

To access Nationwide’s online platform for obtaining auto insurance quotes, simply visit their official website. Look for the section dedicated to insurance quotes or use the search bar to navigate to the right page. Once you’re on the quotes comparison tool, you can begin entering your information to receive personalized quotes.

Entering Personal Information for Accurate Quotes

In order to receive accurate auto insurance quotes from Nationwide, you will need to enter some personal information. This may include details such as your age, driving history, vehicle make and model, and coverage preferences. By providing accurate information, you can ensure that the quotes you receive are tailored to your specific circumstances.

Features Available for Comparing Quotes

Nationwide’s website offers a range of features to help you compare auto insurance quotes effectively. You can adjust coverage levels, deductibles, and limits to see how they impact the cost of your premiums. Additionally, you can compare quotes from different insurers side by side to make an informed decision about which policy is best for you.

Take advantage of these tools to find the right coverage at the best price.

Tips for Saving Money on Auto Insurance with Nationwide

When it comes to auto insurance, saving money is always a top priority. Here are some tips on how to lower your insurance premiums when comparing quotes with Nationwide.

Bundle Policies for Potential Discounts

One of the most effective ways to save money on auto insurance is by bundling your policies. By combining your auto insurance with other types of insurance, such as homeowners or renters insurance, you can often qualify for a discount on your premiums.

Are you looking for the best deals on auto insurance? Look no further than Farmers Auto Insurance Quotes ! With competitive rates and excellent coverage options, Farmers is a top choice for all your car insurance needs. Get a quote today and see how much you could save!

Nationwide offers competitive rates for bundled policies, so be sure to explore this option when comparing quotes.

Leverage Nationwide’s Rewards Programs for Cost Savings

Nationwide offers various rewards programs that can help you save money on your auto insurance. For example, their SmartRide program rewards safe driving habits with discounts on your premiums. By participating in this program and demonstrating safe driving behavior, you can potentially lower your insurance costs.

Additionally, Nationwide offers discounts for factors such as being a good student, having multiple policies, or being a loyal customer. Take advantage of these rewards programs to maximize your savings.

Last Recap

In a nutshell, Nationwide Auto Insurance Quotes Comparison is your ticket to savings and peace of mind. Remember, the power is in your hands to choose wisely and protect what matters most.

Popular Questions

How do I start comparing Nationwide auto insurance quotes?

To begin comparing quotes, visit Nationwide’s online platform, enter your personal information, and explore the coverage options available.

What factors should I consider when comparing auto insurance quotes?

Key factors include coverage options, deductibles, discounts, customer reviews, and ratings to ensure you make an informed decision.

Can I save money on auto insurance with Nationwide?

Absolutely! You can save money by bundling policies, leveraging rewards programs, and comparing quotes to find the best rates.