Farmers Auto Insurance Quotes open the door to savings and reliable coverage. Buckle up as we explore the world of auto insurance with Farmers at the wheel.

From understanding different coverage options to factors affecting your quotes, get ready to revamp your insurance game with Farmers on your side.

Introduction to Farmers Auto Insurance Quotes

Farmers Auto Insurance is a well-known insurance provider that offers coverage for vehicles to protect against financial loss in the event of accidents, theft, or other damages.

Auto insurance quotes are estimates of the cost of insurance coverage provided by Farmers Auto Insurance based on factors such as the type of vehicle, driving history, age, and location of the insured individual.

Importance of Obtaining Quotes from Farmers

- Comparing Rates: Obtaining quotes from Farmers allows you to compare rates with other insurance providers to ensure you are getting the best coverage at the most competitive price.

- Customized Coverage: Farmers offers a variety of insurance options that can be tailored to meet your specific needs, ensuring you have the right level of protection for your vehicle.

- Quality Customer Service: Farmers is known for its excellent customer service, making it easy to get assistance with claims, policy changes, or any other insurance-related inquiries.

- Financial Stability: Farmers has a strong financial standing, providing peace of mind that they will be able to fulfill their obligations in the event of a claim.

Coverage Options Offered by Farmers

When it comes to auto insurance coverage, Farmers offers a variety of options to suit different needs and budgets. Having various coverage options is crucial as it allows drivers to tailor their insurance policy to provide the protection they need in case of an accident or unexpected event.

Liability Coverage

- Liability coverage is mandatory in most states and helps cover costs if you’re found at fault in an accident that causes injuries or property damage to others.

- Farmers offers bodily injury liability and property damage liability to protect you financially in case of a lawsuit.

Comprehensive Coverage

- Comprehensive coverage helps pay for damage to your vehicle caused by events other than a collision, such as theft, vandalism, or natural disasters.

- With Farmers, you can add comprehensive coverage to your policy for added protection.

Collision Coverage, Farmers Auto Insurance Quotes

- Collision coverage helps pay for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object.

- Having collision coverage from Farmers can give you peace of mind knowing that your car is protected in case of an accident.

Uninsured/Underinsured Motorist Coverage

- This coverage helps protect you if you’re involved in an accident with a driver who doesn’t have insurance or enough insurance to cover your expenses.

- Adding uninsured/underinsured motorist coverage from Farmers can help fill the gap in case you’re in an accident with an uninsured driver.

Factors Affecting Farmers Auto Insurance Quotes

When it comes to determining auto insurance quotes, Farmers considers several factors that can influence the final price you are quoted for coverage. These factors are based on various aspects of your driving history, personal information, and the type of coverage you are seeking.One of the most significant factors that affect Farmers auto insurance quotes is personal information.

Are you looking for the best deal on auto insurance? Look no further than Geico Auto Insurance Quotes ! With Geico, you can get a quick and easy quote online in just minutes. Say goodbye to long, complicated forms and hello to savings on your car insurance.

Don’t wait, check out Geico today for the best rates!

This includes details such as your age, gender, marital status, driving record, credit score, and where you live. Insurers use this information to assess your level of risk as a driver and determine the likelihood of you filing a claim.

Driving History

Your driving history plays a crucial role in shaping the auto insurance quotes you receive from Farmers. A clean driving record with no accidents or traffic violations can help lower your premiums, as it demonstrates that you are a responsible and safe driver.

On the other hand, a history of accidents or traffic violations may lead to higher insurance rates due to the increased risk you pose as a driver.

Type of Coverage

The type of coverage you choose also impacts the quotes provided by Farmers. Opting for comprehensive coverage that includes a wide range of protections will naturally result in higher premiums than selecting basic liability coverage. By understanding your coverage needs and choosing wisely, you can potentially lower your insurance quotes while still ensuring adequate protection.

Vehicle Information

The make, model, and year of your vehicle can also affect the insurance quotes you receive. Newer or more expensive cars typically require higher premiums due to the cost of repairs or replacements in case of damage. Additionally, vehicles with advanced safety features may qualify for discounts, helping to reduce insurance costs.

Ways to Lower Insurance Quotes

To potentially lower your auto insurance quotes from Farmers, consider taking steps to improve your driving record, maintain a good credit score, and choose a vehicle with safety features. You can also explore discounts offered by Farmers, such as bundling multiple policies or completing a defensive driving course.

Are you looking for the best auto insurance quotes? Look no further! Check out Geico Auto Insurance Quotes for affordable rates and excellent coverage. Don’t waste any more time, get your quote today and drive with peace of mind!

By being proactive and aware of the factors that influence insurance quotes, you can work towards securing affordable coverage that meets your needs.

How to Obtain Farmers Auto Insurance Quotes

To get Farmers auto insurance quotes, follow these steps:

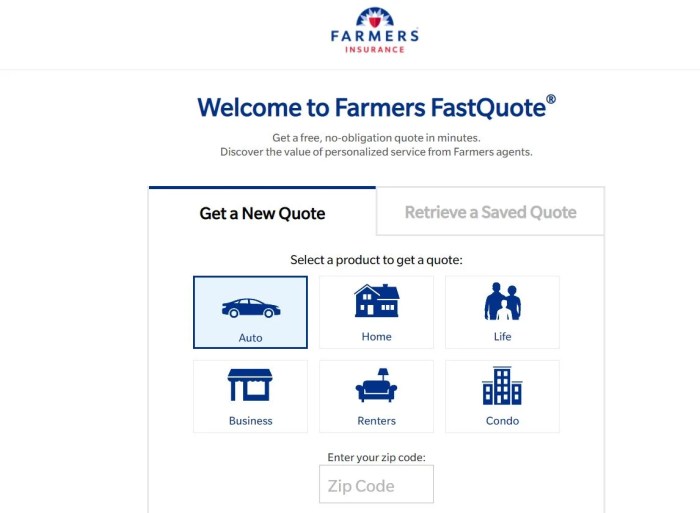

Online Method

- Visit the Farmers Insurance website.

- Locate the “Get a Quote” or “Request a Quote” option.

- Enter your zip code to ensure you are getting accurate quotes for your area.

- Provide the necessary information about yourself, your vehicle, and your driving history.

- Review the quotes provided and select the one that best fits your needs.

Offline Method

- Contact a local Farmers Insurance agent in your area.

- Schedule a meeting or phone call to discuss your insurance needs.

- Provide the agent with the required information to generate quotes for you.

- Review the quotes provided by the agent and ask any questions you may have.

- Select the insurance coverage that suits you best.

Tips for Comparing Quotes

- Ensure you are comparing similar coverage options when looking at quotes from different insurers.

- Consider the deductible amount and how it will affect your premium.

- Look for any discounts or incentives that may be available to help lower your premium.

- Check the financial strength and reputation of the insurance company to ensure they can meet their obligations.

- Read the fine print of each policy to understand any exclusions or limitations.

Conclusive Thoughts

In a nutshell, Farmers Auto Insurance Quotes pave the way for peace of mind on the road. With customizable coverage and competitive rates, why settle for anything less?

Question & Answer Hub

How can I lower my Farmers Auto Insurance quote?

You can potentially lower your quote by maintaining a clean driving record, bundling policies, or opting for a higher deductible.

What types of coverage does Farmers offer?

Farmers offers a range of coverage options including liability, collision, comprehensive, and uninsured motorist coverage.

Can I get Farmers Auto Insurance Quotes online?

Absolutely! You can easily obtain quotes online through the Farmers website or by contacting a local agent.