Compare State Farm vs Progressive Auto Insurance kicks off a showdown between two giants in the insurance industry, promising an epic battle of coverage, pricing, and customer service. Get ready to dive into the details and uncover the best option for your auto insurance needs!

As we delve deeper into the comparison, you’ll discover key insights that will help you make an informed decision between State Farm and Progressive.

Overview of State Farm and Progressive Auto Insurance

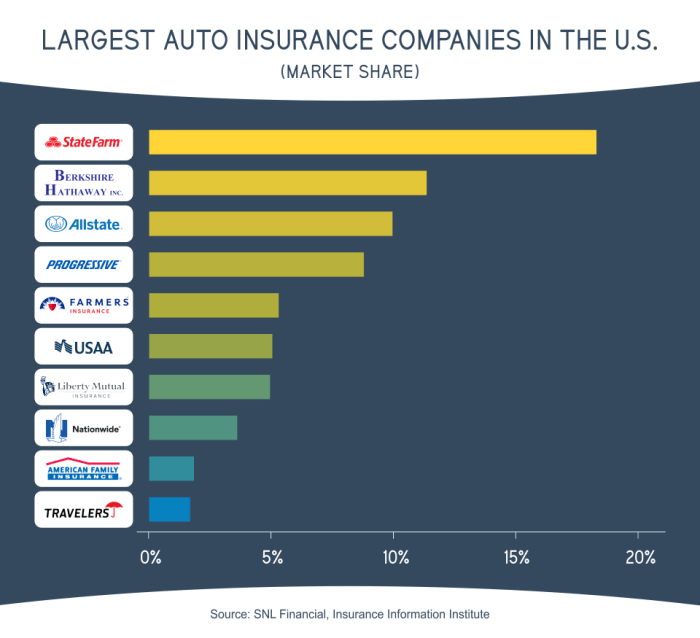

State Farm and Progressive are two well-known insurance companies in the United States, each with its own unique history and reputation in the industry. State Farm:Founded in 1922, State Farm is one of the largest insurance providers in the country.

Are you looking for the best auto insurance quotes? Look no further than State Farm Auto Insurance Quotes ! With State Farm, you can get a personalized quote that fits your needs and budget. Don’t waste any more time searching, click the link and get your quote today!

Known for its extensive network of agents and excellent customer service, State Farm has built a strong reputation for reliability and trustworthiness over the years.Progressive:Progressive, on the other hand, was founded in 1937 and is known for its innovative approach to insurance.

The company was one of the first to introduce usage-based insurance and has a strong online presence, appealing to tech-savvy customers.

Types of Coverage Offered, Compare State Farm vs Progressive Auto Insurance

- State Farm offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments.

- Progressive also provides similar coverage options, along with additional features like roadside assistance and gap insurance.

Financial Strength and Customer Satisfaction Ratings

- State Farm has a strong financial standing, with an A++ rating from A.M. Best. The company also boasts high customer satisfaction ratings, with many policyholders praising their claims process and customer service.

- Progressive is also financially stable, with an A+ rating from A.M. Best. The company has received mixed reviews in terms of customer satisfaction, with some customers praising their competitive rates while others have reported issues with claims handling.

Pricing and Discounts

When it comes to auto insurance, pricing and available discounts play a significant role in choosing the right provider. Let’s take a closer look at how State Farm and Progressive determine their rates and what discounts they offer to their customers.

Rate Determination

State Farm calculates auto insurance rates based on various factors such as the driver’s age, location, driving history, type of vehicle, and coverage options selected. They also consider the frequency of claims in the area where the policyholder resides.Progressive, on the other hand, uses a usage-based insurance program called Snapshot, which monitors driving habits through a mobile app or device installed in the vehicle.

The data collected helps determine the rate based on individual driving behaviors such as speed, braking, and mileage.

Discounts Available

State Farm offers a range of discounts to help customers save on their premiums. These discounts may include multi-policy, good student, accident-free, and defensive driving course discounts. They also provide savings for vehicles with safety features like anti-theft devices and airbags.Progressive provides discounts for safe driving habits monitored through their Snapshot program.

Are you looking for affordable auto insurance quotes? Look no further than State Farm Auto Insurance Quotes ! With State Farm, you can get personalized coverage options to fit your needs and budget. Say goodbye to high premiums and hello to savings with State Farm.

They also offer discounts for bundling policies, paying in full, and having multiple vehicles insured with them. Additionally, discounts are available for loyalty and continuous coverage.

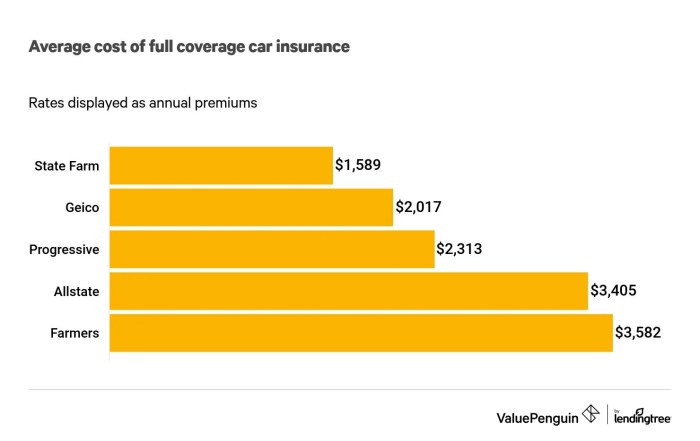

Average Premium Comparison

When comparing the average premiums for similar coverage plans between State Farm and Progressive, it’s essential to consider individual factors that can influence rates. On average, State Farm tends to offer competitive rates for drivers with a clean record and multiple policy discounts.

Progressive, with its usage-based insurance model, may appeal to drivers looking to save based on their driving habits.Overall, the best way to determine which insurance provider offers the most affordable coverage is to obtain personalized quotes based on your specific circumstances and needs.

Coverage Options: Compare State Farm Vs Progressive Auto Insurance

When it comes to auto insurance, having the right coverage options is crucial to protect yourself and your vehicle in case of an accident or other unforeseen circumstances. State Farm and Progressive both offer a variety of coverage options to meet the needs of different drivers.

State Farm Coverage Options

State Farm provides standard coverage options such as liability, comprehensive, and collision insurance. Liability coverage helps pay for damage you cause to others, while comprehensive and collision coverage protect your own vehicle in different scenarios. State Farm also offers uninsured motorist coverage, medical payments coverage, and personal injury protection.

Progressive Unique Add-ons

Progressive stands out with unique add-ons like gap insurance, which covers the difference between what you owe on a car loan and the actual value of your vehicle if it’s totaled. Progressive also offers pet injury coverage, which helps pay vet bills if your pet is injured in a covered accident.

Additionally, they have rideshare coverage for drivers who work for companies like Uber or Lyft.

Flexibility and Customization

When comparing the flexibility and customization of coverage options between State Farm and Progressive, both companies offer a range of choices to tailor your policy to your specific needs. State Farm allows you to add on features like rental car reimbursement, roadside assistance, and rideshare insurance.

On the other hand, Progressive offers unique options like custom parts and equipment value coverage for modifications to your vehicle.Overall, both State Farm and Progressive provide a variety of coverage options to help you build a policy that suits your individual needs and budget.

Customer Service and Claims Process

When it comes to auto insurance, customer service and the claims process are crucial aspects to consider. Let’s take a look at how State Farm and Progressive compare in these areas.

Customer Service Reputation

State Farm is well-known for its personalized customer service, with agents available to assist policyholders with any questions or concerns they may have. On the other hand, Progressive is recognized for its user-friendly online tools and mobile app that make managing policies and claims more convenient for customers.

Claims Process

State Farm offers multiple ways to file a claim, including through their website, mobile app, or by contacting a local agent. Once a claim is filed, State Farm aims to process it efficiently and provide assistance throughout the entire process.

Progressive also allows customers to file claims online or through their app, with a focus on quick processing and resolution.

Availability of 24/7 Support and Online Tools

State Farm provides 24/7 customer support through their hotline, allowing customers to get assistance at any time. They also offer online tools for policy management and claims tracking. Progressive also offers round-the-clock customer support and a variety of online tools to help customers manage their policies and file claims conveniently.

Wrap-Up

As we wrap up our comparison between State Farm and Progressive Auto Insurance, it’s clear that both companies have their strengths and weaknesses. Whether you prioritize customer service, coverage options, or pricing, there’s a perfect fit for everyone. Choose wisely and drive with confidence!

Top FAQs

Which company has a better reputation in the insurance industry?

State Farm is known for its long-standing history and excellent customer service, while Progressive is recognized for its innovative policies and competitive rates. It ultimately depends on your priorities.

What discounts are unique to State Farm and Progressive?

State Farm offers discounts for good students and safe drivers, while Progressive has Snapshot, a usage-based insurance program. Check with each company for specific details.

How do State Farm and Progressive handle claims processing?

State Farm and Progressive both offer online claims filing options and 24/7 customer support. The claims process may vary slightly, so it’s essential to contact them directly for accurate information.