Allstate Auto Insurance Quotes for Teen Drivers bring a mix of excitement and responsibility, exploring the ins and outs of getting the best coverage for young drivers.

From understanding the importance of insurance to uncovering key factors that influence quotes, this guide has you covered.

Introduction to Allstate Auto Insurance Quotes for Teen Drivers

Auto insurance is essential for teen drivers as they are new to the road and more prone to accidents. It provides financial protection in case of unforeseen events while driving.

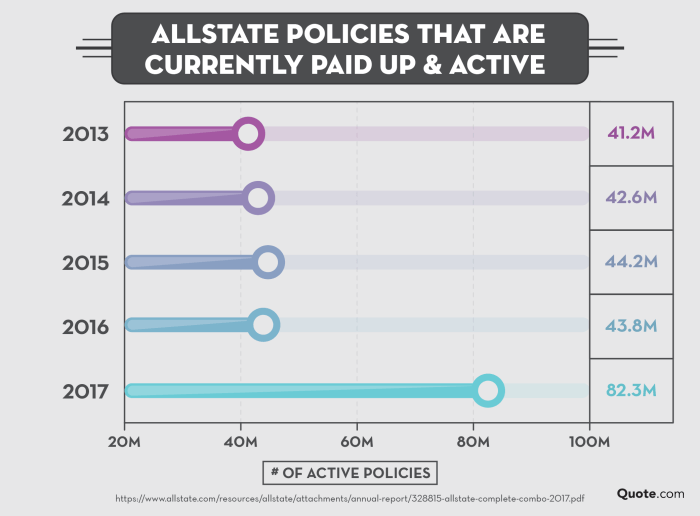

Allstate is a popular choice for teen drivers due to its reputation for excellent customer service, a wide range of coverage options, and competitive rates specifically tailored for young drivers.

Key Factors Influencing Insurance Quotes for Teen Drivers

When it comes to determining insurance quotes for teen drivers, several key factors come into play:

- Age of the Teen Driver: Younger drivers typically face higher insurance premiums due to their lack of driving experience.

- Driving Record: A clean driving record with no accidents or violations can help lower insurance rates for teen drivers.

- Type of Vehicle: The make and model of the car being insured can impact the insurance premium, with sports cars usually costing more to insure.

- Location: The area where the teen driver lives and parks the car can influence insurance quotes, with higher rates in urban areas compared to rural areas.

- Discounts: Allstate offers various discounts for teen drivers, such as good student discounts or safe driving discounts, which can help reduce insurance costs.

Factors Influencing Allstate Auto Insurance Quotes for Teen Drivers

When it comes to determining auto insurance quotes for teen drivers, several factors come into play that can significantly impact the cost of coverage. Here, we will explore how age, driving experience, and vehicle type all influence the insurance premiums for young drivers.

Age Impact on Insurance Quotes

Age is a crucial factor in determining auto insurance rates for teen drivers. Insurance companies typically consider younger drivers to be riskier to insure due to their lack of experience on the road. As a result, teenagers often face higher premiums compared to older, more experienced drivers.

Statistics show that young drivers are more likely to be involved in accidents, which is why insurance rates tend to be higher for this age group.

Are you looking for the best deal on auto insurance? Look no further! Check out this Nationwide Auto Insurance Quotes Comparison to find the most affordable rates that suit your needs. Don’t miss out on saving money and getting the coverage you deserve!

Driving Experience and Insurance Premiums

Driving experience is another significant factor that insurers take into account when calculating premiums for teen drivers. Newly licensed drivers who have just obtained their driver’s license are considered high-risk due to their limited experience behind the wheel. As teen drivers gain more experience on the road and maintain a clean driving record, they may qualify for lower insurance rates over time.

Safe driving practices and completing defensive driving courses can also help reduce insurance costs for teen drivers.

Role of Vehicle Type in Insurance Costs

The type of vehicle a teen driver chooses to insure can also impact insurance costs. Insurance companies consider factors such as the make and model of the car, its safety features, and the likelihood of theft when determining premiums. Sports cars or high-performance vehicles typically come with higher insurance rates for teen drivers due to their increased risk of accidents.

On the other hand, choosing a safe and reliable vehicle with advanced safety features can help lower insurance costs for young drivers.

Discounts and Savings for Teen Drivers with Allstate

When it comes to insuring teen drivers, Allstate offers various discounts and savings opportunities that can help lower insurance premiums. Here are some key ways teen drivers can save money with Allstate:

Good Grades Discount

One of the most common discounts available to teen drivers is the good grades discount. Allstate rewards teen drivers who maintain a certain GPA with lower insurance rates. By demonstrating responsibility and academic achievement, teen drivers can qualify for this discount.

Driver Education Courses

Completing driver education courses can have a positive impact on insurance quotes for teen drivers. By learning safe driving practices and gaining valuable skills on the road, teen drivers can reduce their risk of accidents and potentially qualify for lower insurance premiums with Allstate.

Installing Safety Features

Another way teen drivers can save money on their insurance with Allstate is by installing safety features in their vehicles. Features such as anti-lock brakes, airbags, and anti-theft devices can help reduce the risk of accidents and make teen drivers eligible for discounts on their insurance policies.

Are you looking for the best deal on auto insurance? Look no further than our Nationwide Auto Insurance Quotes Comparison tool! Compare rates from top providers in just a few clicks and find the perfect coverage for your vehicle. Don’t waste time searching multiple websites when you can do it all in one place.

Get started now and save money on your car insurance!

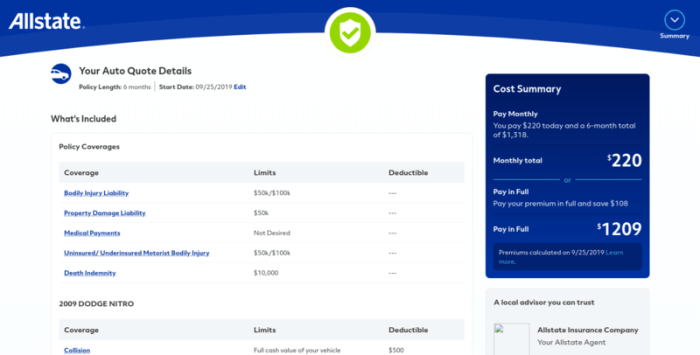

Coverage Options for Teen Drivers with Allstate

When it comes to coverage options for teen drivers with Allstate, there are a few key choices to consider to ensure they have the protection they need on the road.Adding roadside assistance to a policy can provide peace of mind for teen drivers and their parents.

This coverage can help with common issues such as flat tires, dead batteries, and towing, ensuring that help is just a phone call away in case of an emergency.

Liability vs. Full Coverage Options

- Liability coverage: Provides protection for damages or injuries caused to others in an accident where the teen driver is at fault. It does not cover damages to the teen’s own vehicle.

- Full coverage: Includes liability coverage as well as coverage for damages to the teen driver’s vehicle in case of an accident, regardless of fault. This can provide more comprehensive protection but comes with higher premiums.

Benefits of Adding Roadside Assistance

- 24/7 assistance: Teen drivers can have peace of mind knowing that help is available round the clock.

- Convenience: Roadside assistance can help with minor issues like a flat tire or running out of gas, saving time and stress on the road.

- Coverage for multiple vehicles: Roadside assistance can often be extended to cover all vehicles on the policy, providing added value.

Importance of Uninsured/Underinsured Motorist Coverage, Allstate Auto Insurance Quotes for Teen Drivers

- Protection against uninsured drivers: This coverage can help pay for damages if the teen driver is involved in an accident with a driver who does not have insurance.

- Additional peace of mind: Knowing that there is coverage in place in case of an accident with an underinsured driver can provide added security for teen drivers and their families.

Epilogue

As we wrap up our journey through Allstate Auto Insurance Quotes for Teen Drivers, remember to compare rates, explore discounts, and choose the right coverage for peace of mind on the road.

FAQ Compilation

How can good grades affect insurance rates for teen drivers?

Good grades can often qualify teen drivers for discounts on their Allstate insurance premiums, rewarding academic achievement.

What is the significance of adding roadside assistance to an insurance policy?

Roadside assistance can provide valuable support in case of emergencies like breakdowns or flat tires, offering peace of mind for teen drivers and their families.

Why is uninsured/underinsured motorist coverage important for teen drivers?

This coverage protects teen drivers in case they are involved in an accident with a driver who doesn’t have enough insurance to cover the damages, ensuring they are not left with hefty expenses.