Allstate Auto Insurance Quotes for Teen Drivers – Buckle up as we explore the ins and outs of getting the best rates for young drivers. From factors considered to discounts available, this guide has got you covered.

If you’re a teen driver or a parent looking to save on insurance, you’re in the right place. Let’s dive in!

Understanding Allstate Auto Insurance Quotes for Teen Drivers

When it comes to providing auto insurance quotes for teen drivers, Allstate takes various factors into consideration to determine the level of risk associated with insuring them.Allstate considers the following key factors when customizing insurance quotes for teenage drivers:

Age

- Younger drivers, especially teenagers, are considered higher risk due to their lack of driving experience and tendency for riskier behaviors on the road.

- As a result, insurance quotes for teen drivers are often higher compared to older, more experienced drivers.

Driving Experience

- Allstate takes into account the length of time a teen driver has been licensed and their history of accidents or traffic violations.

- Teen drivers with more experience and a clean driving record may receive lower insurance quotes compared to those with less experience and a history of accidents.

Type of Vehicle

- The make and model of the vehicle being insured also play a role in determining insurance quotes for teen drivers.

- High-performance or luxury vehicles may result in higher insurance premiums for teen drivers due to their increased cost of repair and likelihood of being involved in accidents.

Discounts and Savings for Teen Drivers with Allstate Auto Insurance

When it comes to insuring teen drivers, Allstate offers various discounts and savings opportunities to help make insurance more affordable for young drivers. By taking advantage of these discounts, teen drivers and their families can save money while still getting the coverage they need.

Good Grades Discount

One way that teen drivers can save on their Allstate auto insurance is by maintaining good grades. Allstate offers a discount for students who achieve a certain GPA or are on the honor roll. This incentive encourages teens to focus on their studies while also rewarding them with lower insurance premiums.

Driver Education Course Discount

Completing a driver education course can also lead to savings on Allstate auto insurance for teen drivers. These courses provide valuable knowledge and skills that can help young drivers become safer on the road. By completing a recognized driver education program, teens can qualify for a discount on their insurance premiums.

Safe Driving Habits Discount

Allstate rewards teen drivers who demonstrate safe driving habits on the road. By avoiding accidents and traffic violations, teen drivers can qualify for a safe driving discount. This not only helps teens save money on insurance but also promotes responsible driving behaviors.

Bundling Policies Discount

Another way for teen drivers to save on Allstate auto insurance is by bundling policies. By combining auto insurance with other types of insurance, such as homeowners or renters insurance, families can qualify for a discount on their overall premiums.

Are you a military member looking for auto insurance quotes? Look no further than USAA Auto Insurance Quotes for Military Members ! USAA offers special discounts and benefits for those who have served our country. With competitive rates and top-notch customer service, USAA is a trusted choice for military personnel.

Get your personalized quote today!

This can be a great way to save money while getting comprehensive coverage.

Safety Features Discount

Installing safety features in the vehicle, such as anti-theft devices or passive restraint systems, can also lead to savings on Allstate auto insurance for teen drivers. These safety features help reduce the risk of theft or injury, making the vehicle safer to insure.

By taking proactive measures to enhance vehicle safety, teen drivers can lower their insurance costs.

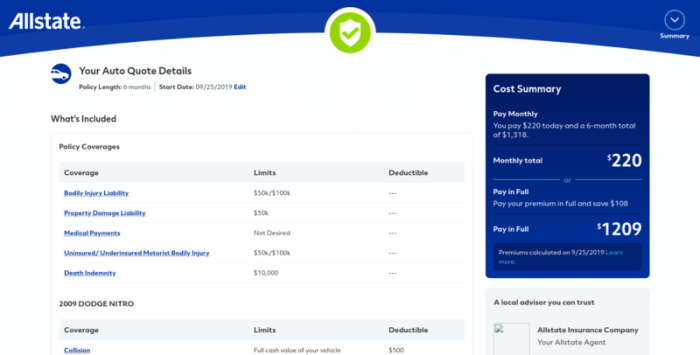

Coverage Options for Teen Drivers under Allstate Auto Insurance

When it comes to insuring teen drivers, Allstate offers a range of coverage options to ensure they are protected on the road. Let’s explore the different types of coverage tailored for teen drivers by Allstate.

Liability, Collision, and Comprehensive Coverage

- Liability coverage is essential for teen drivers as it protects them in case they are at fault in an accident and need to cover the costs of damage or injuries to others.

- Collision coverage helps pay for repairs to the teen driver’s car if they are involved in a collision with another vehicle or object.

- Comprehensive coverage protects against damage to the teen driver’s car from non-collision incidents such as theft, vandalism, or natural disasters.

Adding Roadside Assistance or Rental Reimbursement

- Adding roadside assistance to a teen driver’s policy can provide peace of mind knowing that help is just a phone call away in case of a breakdown or flat tire.

- Rental reimbursement is a valuable addition as it covers the cost of a rental car if the teen driver’s car is in the shop for repairs after an accident.

Tips for Teen Drivers to Lower Insurance Premiums with Allstate

As a teen driver, it’s important to take steps to lower your insurance premiums with Allstate. By improving your driving record and taking proactive measures, you can qualify for lower rates. Here are some tips to help you on your way.

Are you a military member looking for affordable auto insurance? Look no further than USAA Auto Insurance Quotes for Military Members. USAA offers special rates and benefits tailored specifically for those who serve our country. Get a quote today and see how much you can save!

Driving Record Improvement, Allstate Auto Insurance Quotes for Teen Drivers

Maintaining a clean driving record is crucial for lowering your insurance premiums. Avoiding traffic violations, accidents, and other incidents can demonstrate to Allstate that you are a responsible and safe driver. Here are some ways to improve your driving record:

- Follow all traffic laws and regulations.

- Avoid distractions while driving, such as texting or using your phone.

- Attend a defensive driving course to enhance your skills.

- Drive defensively and anticipate potential hazards on the road.

Parental Involvement

Parents can play a significant role in helping their teen drivers build a safe driving history. By setting a good example, providing guidance, and enforcing rules, parents can help their teens become responsible drivers. Here are some ways parents can support their teen drivers:

- Establish and enforce curfews and driving restrictions.

- Monitor your teen’s driving habits and provide feedback for improvement.

- Encourage open communication about driving experiences and challenges.

- Set clear expectations for responsible driving behavior.

Significance of Clean Driving Record

Maintaining a clean driving record not only ensures your safety on the road but also impacts your insurance rates. Allstate considers your driving history when determining your premiums, so a clean record can lead to lower costs. Remember that safe driving habits not only benefit you but also contribute to safer roads for everyone.

Wrap-Up

Ready to hit the road with the best insurance rates for teen drivers? With Allstate, you can drive confidently knowing you’ve got the coverage you need at a price you can afford. Stay safe out there!

Commonly Asked Questions

What factors does Allstate consider when providing auto insurance quotes for teen drivers?

Allstate considers factors like age, driving experience, and the type of vehicle when determining insurance quotes for teen drivers.

What discounts are available for teen drivers with Allstate auto insurance?

Teen drivers can save with discounts for good grades, driver education courses completion, safe driving habits, bundling policies, or installing safety features.

What coverage options does Allstate offer for teen drivers?

Allstate provides various coverage options tailored for teen drivers, including liability, collision, comprehensive coverage, roadside assistance, and rental reimbursement.

How can teen drivers lower insurance premiums with Allstate?

Teen drivers can improve their driving record, parents can help build a safe driving history, and maintaining a clean driving record is significant for lower insurance rates.