Nationwide vs Geico Auto Insurance Quotes Comparison sets the stage for a showdown between two major insurance players, offering insights into their key features, coverage options, pricing, and customer service. Get ready to dive into the world of auto insurance with a twist!

Ready to uncover the nuances of Nationwide and Geico auto insurance? Let’s compare and contrast these industry giants to help you make an informed decision.

Overview of Nationwide and Geico Auto Insurance

When it comes to auto insurance, Nationwide and Geico are two well-known companies that offer a variety of coverage options to meet the needs of different drivers. Let’s take a closer look at what each company has to offer:

Nationwide Auto Insurance

Nationwide is a trusted insurance provider that has been in the industry for decades. They offer a wide range of coverage options, including liability, collision, comprehensive, and more. Nationwide is known for their excellent customer service and personalized approach to insurance.

- Key Features:

- Multiple coverage options to choose from

- Discounts for safe drivers and bundling policies

- 24/7 claims service for quick assistance

- Reputation:

- Nationwide is well-regarded for their financial stability and strong customer satisfaction ratings

- They have a solid reputation for handling claims efficiently and providing support to policyholders

Geico Auto Insurance

Geico is another popular choice for auto insurance, known for their competitive rates and user-friendly online tools. They offer a variety of coverage options, including liability, collision, comprehensive, and more. Geico is also known for their humorous advertising campaigns.

- Key Features:

- Easy online quotes and policy management

- Discounts for good drivers, military members, and federal employees

- 24/7 customer service for assistance with claims and policy questions

- Reputation:

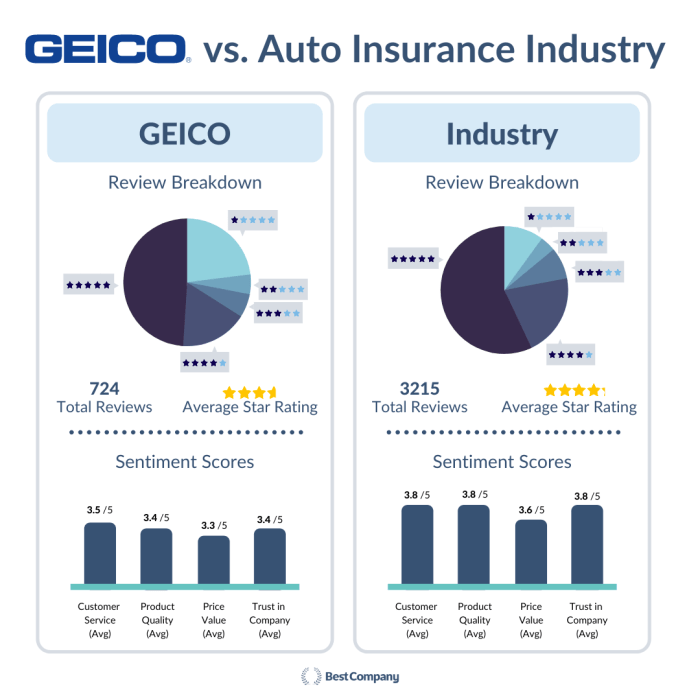

- Geico is highly rated for their affordable rates and accessible online tools

- Customers appreciate the simplicity and convenience of managing their policies online

Coverage Options

When comparing auto insurance quotes from Nationwide and Geico, it’s important to consider the coverage options each company offers. Let’s take a closer look at the differences in coverage limits, deductibles, and additional features provided by Nationwide and Geico.

Liability Coverage

- Nationwide offers liability coverage with limits that can be customized to suit your needs, providing financial protection in case you are at fault in an accident.

- Geico also provides liability coverage with flexible limits, allowing you to choose the amount of coverage that best fits your budget and requirements.

Collision Coverage, Nationwide vs Geico Auto Insurance Quotes Comparison

- Nationwide’s collision coverage helps pay for repairs to your vehicle if you are involved in a collision with another vehicle or object.

- Geico offers collision coverage with different deductible options, allowing you to select the amount you are comfortable paying out of pocket.

Comprehensive Coverage

- With Nationwide, comprehensive coverage can help protect your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Geico’s comprehensive coverage also includes protection against a variety of risks outside of collisions, providing peace of mind for unexpected events.

Pricing and Discounts: Nationwide Vs Geico Auto Insurance Quotes Comparison

When it comes to auto insurance, pricing and discounts play a crucial role in determining which company offers the best value for your money. Let’s take a closer look at how Nationwide and Geico approach pricing and the discounts they offer.

How Nationwide and Geico determine auto insurance prices

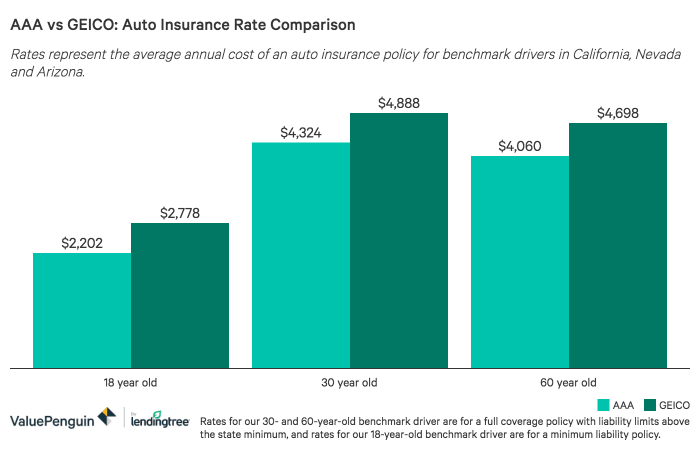

Nationwide and Geico both take into account several factors when determining auto insurance prices. These factors typically include the driver’s age, driving record, location, type of vehicle, and coverage options selected. Additionally, both companies may consider additional factors such as credit score, marital status, and annual mileage.

So, you’re torn between State Farm and Progressive for your auto insurance, huh? Let’s break it down! State Farm is known for personalized service and a wide network of agents, while Progressive is famous for their user-friendly online tools and competitive rates.

To help you decide, check out this detailed comparison of State Farm vs Progressive Auto Insurance !

Compare typical premiums for similar coverage options

While the actual premiums can vary based on individual circumstances, it’s important to compare typical premiums for similar coverage options between Nationwide and Geico. In general, Geico is known for offering competitive rates, especially for drivers with a clean driving record.

Are you torn between choosing State Farm or Progressive for your auto insurance? Let’s compare the two giants in the industry! Check out this detailed comparison between State Farm vs Progressive Auto Insurance to see which one suits your needs and budget better.

On the other hand, Nationwide may appeal to those looking for additional coverage options and personalized service.

Identify and discuss any unique discounts offered by each company

Nationwide and Geico offer a variety of discounts to help drivers save on their auto insurance premiums. Geico is known for its multi-policy discount, which allows customers to save money by bundling their auto insurance with other policies such as homeowners or renters insurance.

Nationwide, on the other hand, offers discounts for safe driving habits, as well as loyalty discounts for long-time customers.

Customer Service and Claims Process

When it comes to auto insurance, having a reliable customer service team and a smooth claims process can make all the difference. Let’s take a closer look at how Nationwide and Geico stack up in these areas.

Customer Service Experience

- Nationwide: Nationwide is known for its friendly and helpful customer service representatives who are available to assist policyholders with any questions or concerns. Customers appreciate the personalized attention they receive when dealing with Nationwide’s customer service team.

- Geico: Geico is praised for its efficient and responsive customer service. Policyholders often report quick response times and knowledgeable representatives who are able to address their needs effectively.

Claims Process

- Nationwide: Nationwide offers a straightforward claims process that can be initiated online, over the phone, or through the mobile app. Policyholders have access to a network of approved repair shops and can track the progress of their claim easily.

- Geico: Geico’s claims process is known for being user-friendly and efficient. Policyholders can file a claim online or through the mobile app and track its progress every step of the way. Geico also offers a repair guarantee for the work done on your vehicle.

Customer Reviews and Experiences

“I had a minor fender bender and Nationwide’s claims process was so smooth and hassle-free. The customer service team was very supportive throughout the entire process.”

Satisfied Nationwide customer

“Geico’s customer service is top-notch! I was involved in an accident and their claims team handled everything professionally and quickly. I was back on the road in no time.”

Happy Geico policyholder

End of Discussion

In conclusion, Nationwide and Geico both bring their A-game to the table when it comes to auto insurance. Whether you prioritize coverage options, pricing, or customer service, weighing the pros and cons of each can lead you to the perfect choice for your needs.

Make sure to explore all aspects before choosing your ideal auto insurance provider.

Query Resolution

Which company offers better coverage options, Nationwide or Geico?

Both Nationwide and Geico offer a range of coverage options, but the best choice depends on your specific needs and preferences. It’s recommended to compare their plans to see which aligns more closely with what you’re looking for.

Do Nationwide and Geico provide similar pricing for auto insurance?

Pricing for auto insurance can vary based on multiple factors, including your location, driving history, and the coverage options you choose. It’s advisable to request quotes from both companies to determine which one offers the most competitive rates for your situation.

How do Nationwide and Geico handle customer service and claims processing?

Nationwide and Geico both strive to provide excellent customer service and efficient claims processing. Reading reviews from policyholders can give you insights into their experiences and help you decide which company may be a better fit for you.