As Compare State Farm vs Progressive Auto Insurance takes center stage, this comparison promises to unravel the mysteries behind these two insurance giants, providing you with all the essential details you need to make an informed decision.

From coverage options to pricing, customer service to financial stability, this showdown will guide you through the intricate world of auto insurance, ensuring you walk away with the knowledge to choose the best fit for your needs.

Introduction to State Farm and Progressive Auto Insurance

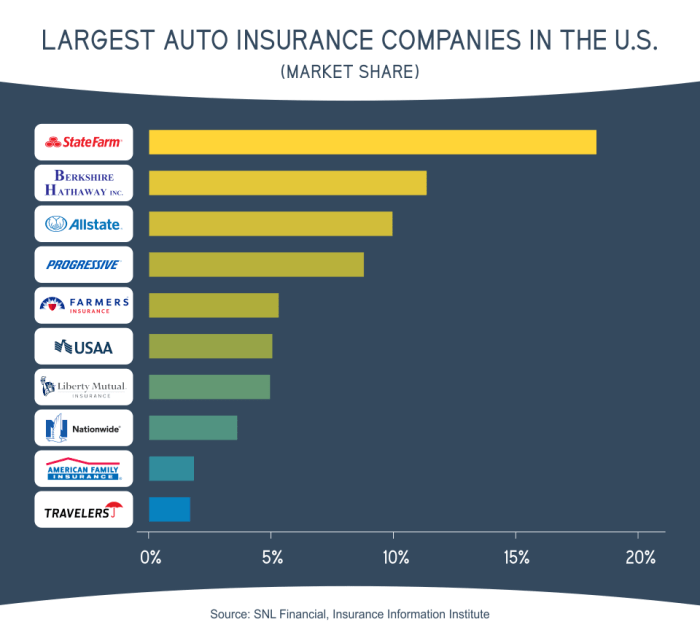

State Farm:State Farm was founded in 1922 by George J. Mecherle, a retired farmer and insurance salesman. It has grown to become one of the largest auto insurance providers in the United States, known for its wide range of insurance products and excellent customer service.Progressive Auto Insurance:Progressive Auto Insurance was founded in 1937 by Jack Green and Joe Lewis.

Are you looking for the best deal on auto insurance? Look no further than Allstate Auto Insurance Quotes ! With Allstate, you can get competitive rates and top-notch coverage to protect you on the road. Don’t wait until it’s too late, get your quote today and drive with peace of mind.

It is known for being an innovative insurance company, being the first to introduce features like comparison rates and the ability to purchase insurance directly online.

Types of Insurance Coverage Offered

State Farm:

- Auto Insurance

- Home Insurance

- Life Insurance

- Renters Insurance

Progressive Auto Insurance:

- Auto Insurance

- Home Insurance

- Renters Insurance

- Boat Insurance

Target Market

State Farm:State Farm caters to a wide range of customers, from individuals looking for basic insurance coverage to families seeking comprehensive protection for their assets.Progressive Auto Insurance:Progressive targets tech-savvy consumers who prefer to manage their insurance online and want access to innovative tools for comparing rates and customizing their coverage.

Coverage Offered

When comparing State Farm and Progressive Auto Insurance, it’s essential to understand the types of coverage each company offers. Let’s take a closer look at the coverage options provided by both insurers.

Liability Coverage

State Farm and Progressive both offer liability coverage, which helps pay for injuries or property damage you cause to others in a car accident. State Farm provides bodily injury and property damage liability coverage, while Progressive offers bodily injury and property damage liability as well as personal injury protection (PIP) in some states.

Comprehensive and Collision Coverage

State Farm and Progressive also provide comprehensive and collision coverage, which help pay for damages to your own vehicle. State Farm offers additional options like rental car reimbursement and roadside assistance, while Progressive includes gap insurance and custom parts coverage.

Uninsured/Underinsured Motorist Coverage

Both State Farm and Progressive offer uninsured/underinsured motorist coverage, which protects you if you’re in an accident with a driver who doesn’t have insurance or enough insurance to cover the damages. State Farm provides options for stacking coverage and underinsured motorist property damage coverage, while Progressive offers coverage for hit-and-run accidents.

Unique Coverage Options

State Farm offers unique coverage options like rideshare insurance for drivers who work for companies like Uber or Lyft. On the other hand, Progressive provides Snapshot, a usage-based insurance program that uses telematics to track your driving habits and potentially lower your rates based on your safe driving behavior.In conclusion, while both State Farm and Progressive Auto Insurance offer essential coverage options like liability, comprehensive, collision, and uninsured/underinsured motorist, they also provide unique and exclusive coverage options that cater to different needs and preferences.

Pricing and Discounts

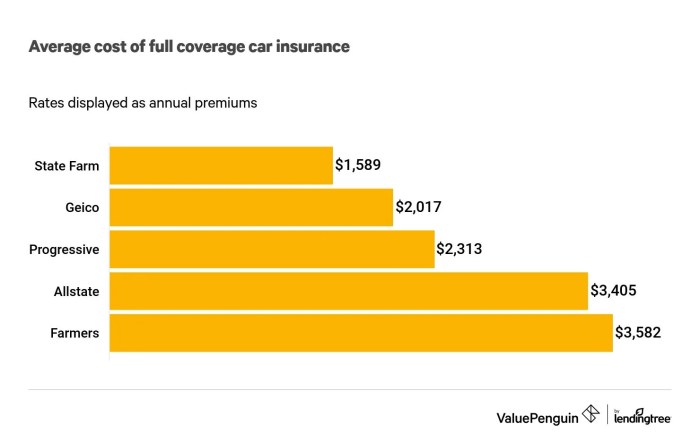

When it comes to auto insurance, pricing and discounts play a crucial role in determining which company is the best fit for you. Let’s take a look at how State Farm and Progressive Auto Insurance compare in terms of pricing structure and discounts offered.

Pricing Structure

Both State Farm and Progressive use various factors to determine insurance premiums, including driving record, location, vehicle type, and coverage options. State Farm typically offers competitive rates based on these factors, while Progressive is known for its usage-based insurance program, Snapshot, which tracks driving habits to potentially lower premiums.

Common Discounts

- Multi-policy discount: Both State Farm and Progressive offer discounts when you bundle auto insurance with other policies like home or renters insurance.

- Safe driver discount: If you have a clean driving record, you may be eligible for a discount with both companies.

- Good student discount: Students with good grades can save on their premiums with State Farm and Progressive.

- Anti-theft device discount: Installing anti-theft devices in your vehicle can lower your insurance costs with both insurers.

Factors Affecting Premiums

Factors like driving record, location, and vehicle type can significantly impact insurance premiums. A clean driving record typically leads to lower rates, while living in an area with high crime rates or traffic congestion may result in higher premiums. Additionally, the type of vehicle you drive, its safety features, and its likelihood of theft or damage are all taken into consideration when calculating insurance costs.

Customer Service and Claims Process

When it comes to auto insurance, having reliable customer service and a smooth claims process is crucial. Let’s take a look at how State Farm and Progressive Auto Insurance compare in this aspect.

State Farm, Compare State Farm vs Progressive Auto Insurance

State Farm is known for its personalized customer service, with a large network of agents ready to assist policyholders. When it comes to filing a claim, State Farm offers multiple channels such as phone, online, or through their mobile app.

The claims process is generally straightforward, and customers appreciate the ease of filing a claim. State Farm also has a good reputation for quick turnaround times in processing claims, providing peace of mind to their policyholders.

Progressive Auto Insurance

Progressive is known for its user-friendly online platform and 24/7 customer service availability. Policyholders can easily file a claim online or through the mobile app, making the process quick and convenient. Progressive also offers a feature called “Name Your Price Tool,” which allows customers to customize their coverage based on their budget.

Customers have reported positive experiences with Progressive’s claims process, citing efficient handling and clear communication throughout.Overall, both State Farm and Progressive Auto Insurance have strong customer service and efficient claims processes, making them reliable choices for auto insurance coverage.

Financial Strength and Stability: Compare State Farm Vs Progressive Auto Insurance

When it comes to choosing an auto insurance provider, considering the financial strength and stability of the company is crucial. This aspect can impact their ability to pay out claims promptly and provide reliable service to policyholders.

State Farm, Compare State Farm vs Progressive Auto Insurance

State Farm is known for its strong financial stability, with high ratings from major credit rating agencies such as AM Best, Moody’s, and Standard & Poor’s. These ratings indicate the company’s ability to meet its financial obligations and handle claims efficiently.

State Farm has a long-standing reputation for financial strength, which can provide peace of mind to policyholders.

Progressive Auto Insurance

Progressive Auto Insurance also boasts solid financial ratings from reputable agencies like AM Best, Moody’s, and Standard & Poor’s. The company has demonstrated financial stability over the years, ensuring that they can fulfill their commitments to policyholders. This strong financial standing contributes to Progressive’s credibility and reliability as an insurance provider.Overall, both State Farm and Progressive Auto Insurance have established themselves as financially stable companies in the insurance industry.

Policyholders can trust that these companies have the resources to pay out claims and provide consistent service, even during challenging times.

Are you looking for the best deals on auto insurance? Look no further! Get your Allstate Auto Insurance Quotes today and see how much you can save. Don’t miss out on this opportunity to protect your car and your wallet at the same time!

Technology and Mobile Apps

State Farm and Progressive Auto Insurance both offer mobile apps to make managing your insurance policies easier. Let’s take a closer look at the features and user experience of their mobile apps.

State Farm Mobile App

The State Farm mobile app allows customers to easily pay their bills, manage their policies, file and track claims, and access their insurance ID cards on the go. The app also offers features like roadside assistance and the ability to contact your agent directly through the app.

Overall, the State Farm app is known for its user-friendly interface and smooth navigation.

Progressive Auto Insurance Mobile App

Progressive’s mobile app offers similar features such as bill payment, policy management, claims tracking, and digital ID cards. In addition, Progressive’s app includes tools like Snapshot, which monitors your driving habits to potentially lower your rates. The app is praised for its intuitive design and convenient access to important insurance information.Both State Farm and Progressive Auto Insurance have invested in developing robust mobile apps that cater to the needs of their customers.

Whether you prefer State Farm’s straightforward interface or Progressive’s innovative tools like Snapshot, both apps are designed to provide a seamless and convenient user experience for policyholders.

Final Conclusion

In conclusion, whether you’re leaning towards the reliability of State Farm or the innovation of Progressive Auto Insurance, this comparison has shed light on the key aspects of each provider, empowering you to select the ideal coverage for your vehicle.

Now, armed with this knowledge, you can hit the road with confidence, knowing you have the right protection by your side.

Commonly Asked Questions

Which company offers better pricing?

While pricing can vary based on individual factors, State Farm is known for competitive rates, whereas Progressive may offer more discounts.

What unique coverage options does State Farm provide?

State Farm offers rideshare insurance, which is beneficial for drivers working for companies like Uber or Lyft.

How do I file a claim with Progressive Auto Insurance?

You can easily file a claim with Progressive through their website, mobile app, or by calling their claims department.